This is the season for Idaho districts to look at how to balance their budgets. An unprecedented number have turned to supplemental property tax levies. You may face one soon on the ballot in your area. There is often finger-pointing when we have to make difficult choices. I want to make the reasons for this situation clear. Then I want you to talk to your legislator.

Before the property tax reform law of 2006, school districts were allowed to collect property tax up to an amount equal to 0.3% of the property valuation in their taxing districts if the district trustees approved. At that time about 25% of school funding came from local property taxes. The state tried to make up for the varied property values in different districts by distributing funds to districts on an “equalized” basis. So if Potlatch School District had half of the property tax base per student as Moscow, Potlatch would receive about twice as much per student as Moscow from the state, since Moscow could raise twice the revenue with the same property tax rate. This was an attempt to satisfy the state’s constitutional obligation for free, common and uniform schools.

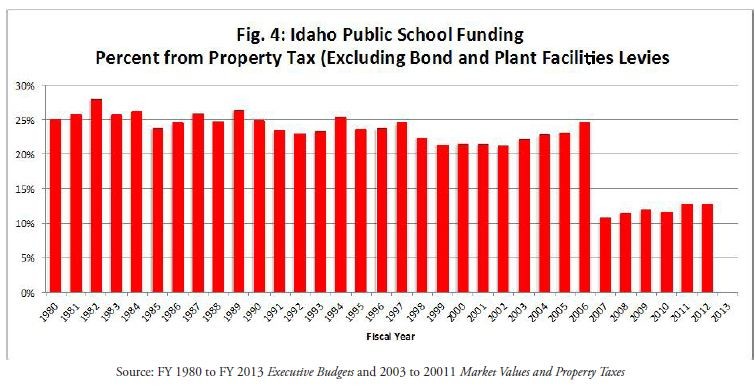

In a 2006 one-day special session the legislature eliminated local schools ability to levy local tax with the trustees’ approval at 0.3% and the equalization formula was removed. This meant a $260 million dollar cut to schools from local property tax. Districts could still run supplemental levies, and almost all now do. This meant property tax support for local schools in Idaho dropped from 25% to about 12 % of their budgets.

Idaho’s property tax contribution to schools changed dramatically in 2006.

The promise was made that schools would be made whole with a 1% increase in sales tax distributed from the state general fund (NOT equalized). This swap meant the state paid back to schools $210M in sales tax increase after removing $260M in property tax. This was OK until 2008 when the sales tax revenue took a steep dive. Per student school funding is still not back up to the 2008 level, and per person support for schools in Idaho has dropped by 25% in the last 10 years. Property tax money for schools is now 25% less than before 2006 and there is no equalization formula, so the funding for each district is less but more varied. Poor districts have much less than rich districts. Idaho ranks at the bottom for per pupil spending and ranks at the top for greatest variation in per pupil spending from one district to another. And finally, Idaho has one of the highest rates for state dollar spending on schools from state general fund (sales and income tax).

In short, we have moved school funding from local property taxes that the state worked to equalize so property-poor districts had the same support as land rich ones, to now being based on the unstable state income and sales taxes with little effort toward equalization. Local districts are trying to make up for the failure of the legislature with supplemental levies, but the property wealth disparity cannot be overcome district by district. The difference in tax base is too great. This has made Idaho school funding clearly unconstitutional. It needs to change. Talk to your legislator.

Public education should be the foundation of a fair opportunity for all. All students get a fair chance to make what they can of this “general, uniform and thorough system of public free, common schools.”(Idaho Constitution Article IX, Section 1) The Idaho Legislature is ignoring it’s oath to the Idaho Constitution and to our next generations. We have no excuse.