My expertise lies not in the law. The constitution of our nation and our state are the laws of the land, and as an elected representative I am sworn to uphold these laws. So when I read the constitution and think it means one thing, and the experts tell me another, I very carefully listen and make a judgment.

In my last post I suggested that our state founders thought corporate personal property should, indeed must be taxed. I cited Article 7 Section 8:

ARTICLE VII FINANCE AND REVENUE

Section 8. CORPORATE PROPERTY MUST BE TAXED. The power to tax corporations or corporate property, both real and personal, shall never be relinquished or suspended, and all corporations in this state or doing business therein, shall be subject to taxation for state, county, school, municipal, and other purposes, on real and personal property owned or used by them, and not by this constitution exempted from taxation within the territorial limits of the authority levying the tax.

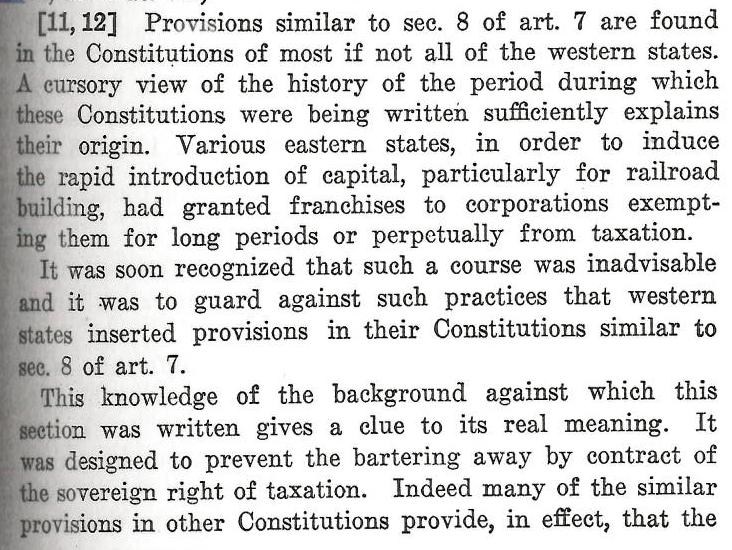

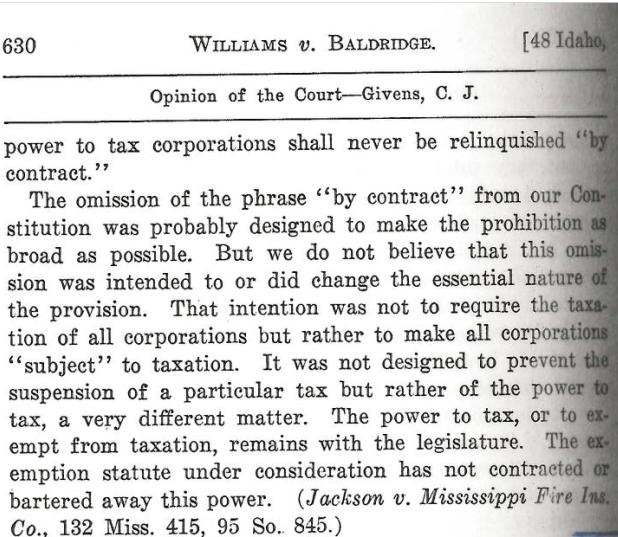

Learned scholars have interpreted this to mean that the State of Idaho cannot relinquish the power of taxation on corporate personal property, otherwise how could the exemptions that have occurred over the years be allowed? I was mailed this citation from a 1930 Idaho Supreme Court decision, and it was mentioned by the lawyer for the Attorney General:

Sent to me by an old constitutional lawyer

Who knows more than meSo it is clear, the interpretation of Section 8 means the Legislature has the power to exempt and even remove taxation of Corporate Personal Property. We cannot relinquish the power to tax, though we may chose not to impose such tax. It is also clear from another legal interpretation that if the legislature, by removing this tax, forces counties or municipalities to default on obligations (bonds) or not fulfill their statutory (indigent health care, law enforcement, jails, mental health) or constitutional (schools) obligations, the legislature would be in violation of its constitutional authority. I hope we can proceed with wisdom and justice.

I draw your attention to the title of the section:

CORPORATE PROPERTY MUST BE TAXED

Whenever we hear a bill read on the floor of the Senate and it comes before us to debate and vote, the President of the Senate asks, “Are there corrections to the title?” He pauses and has always gone on with, “Hearing none, the title is approved. The secretary may read the bill.”

If I had been in the Idaho Constitutional Senate in 1889 and heard this title read and back then in my frock coat with a spittoon by my desk, and I also with the benefit of time machine wisdom I had my present day experience, I would have objected and asked that the title be amended to read:

CORPORATE PROPERTY MAY BE TAXED

I vow to pay better attention when the president of the Senate asks for corrections to the title. And I’ll try to have a clearer vision of the future. Presently, my glass through to the future remains dim.

*****

All comments are read but not posted.