The legislature here in Idaho faces pressure to eliminate the business personal property tax. We have been talking about it for years. The pressure feels like a huge freight train coming at us, while we are tied to the tracks. We need to think clearly and not panic in the face of such pressure, as no hero will come to untie the binds to save us. We must save ourselves.

Many say the business personal property tax is a bad tax, and it may be more so than others, but that argument could be made for all taxes. Let’s look at it with the principles of fairness in mind. Businesses that own real estate pay tax on the land, just like a home owner. Businesses that buy things pay sales tax, like a mom in a grocery store. Businesses that make income pay income tax, like a construction worker. To add, businesses that own tangible property, other than land, that they use for their business, like a contractor’s tools or an accountant’s computers or a doctor’s stethoscopes, pay tax on the estimated value of these items. This is called business personal property tax.

I remember when I first came to Moscow to practice medicine I received two letters from the county. The first was a summons for jury duty. The second was a letter from the county assessor, asking me to list all of my personal property I would use in my business and estimate its value. My medical school books had been very expensive, and I thought I would use them in the treatment of patients. In addition, I had two stethoscopes, both given to me, but I figured they were worth a hundred bucks each. So I sent the list in and waited for the call to serve on a jury. I was never called for jury duty, but I did get a bill from the county assessor for $1.25. Over the years I kept getting those bills but my valuation of the books diminished, and when the payment became less than the postage, they stopped.

Back then I was annoyed by this silly tax and thought I could provide better value seeing patients than doing jury duty. But as I now reflect, I think these are fair costs a citizen and businessman should pay to be in our state, our civic duty. But the unfairness and the burden of this tax for businesses as well as the difficulty collecting it and inaccuracy of self reporting have been argued to the legislature for years. Finally in 2008, at the peak of an economic boom, the Idaho legislature passed a law exempting all businesses from the taxation of the first $100K of business personal property. The counties who collected this revenue would now lose it, and it would have to be reimbursed from the state general fund through sales and income tax revenue. But as economic circumstances turned for the worse in 2008, the legislature decided to put a trigger that would postpone the tax relief. In other words, it would only take effect if the state economy grew more than 4.8% or if state tax revenues rose above those in 2008. We have not reached these triggers yet but it looks like we might in 2014 or 2015. As a result of this, the folks who want this tax to go away are in a hurry.

Remember the 80:20 rule. In medicine, 20% of the patients are responsible for 80% of the costs, and 20% of the doctors are responsible for 80% of malpractice claims. Along the same lines, if we exempt the first $100K of business personal property from this tax, 85% of businesses will pay nothing, but only 20% of the tax will be eliminated. The result is the big businesses pay most of this tax, and that is why they are pushing hard to make this go away.

Why do we even tax corporations on tangible property? Many states have decided it is necessary, as forty one have the tax, and only nine do not. In the 1880’s, when the Idaho Constitution was being written, several eastern states decided to overturn the business personal property tax. But our founders saw such a choice as a ploy to attract large business to the state and such a policy would starve the state of revenue and lead Idaho to a “race to the bottom” with other states. I believe Idaho retained the tax for important reasons. I believe the legislature must follow the first Idahoans and resist succumbing to the same pressure faced today.

Read this section of the Idaho Constitution carefully:

ARTICLE VII FINANCE AND REVENUE

Section 8. CORPORATE PROPERTY MUST BE TAXED. The power to tax corporations or corporate property, both real and personal, shall never be relinquished or suspended, and all corporations in this state or doing business therein, shall be subject to taxation for state, county, school, municipal, and other purposes, on real and personal property owned or used by them, and not by this constitution exempted from taxation within the territorial limits of the authority levying the tax.

I believe our founders had important reasons for writing this into the Idaho Constitution. Historically, railroad companies and mining businesses were the large corporations that had the potential to make a lot of money and hold sway in our early state. There was no income tax in those days. Yet, our founders knew if you wanted to be a citizen of this state, do business here and make a profit, corporations should contribute to the public good. This tax was a way to maintain such a relationship between the public good and the corporate privilege to profit.

Many lawyers I have spoken with do not consider the above section of the Idaho Constitution an impediment to repealing the business personal property tax, despite what I consider to be clear language that prohibits such action. Legal arguments aside, we should respect the intent of such language. Idaho’s founders knew we must maintain a solvency for civic well-being. This tool they thought critical. Now reflect on this:

On the basis of taxes paid per person, Idaho’s overall tax burden ranks 51st nationally (out of 51) and 11th regionally (out of the 11 western states).

| Type of Tax | National Ranking | % Compared to National Average | Regional Ranking | % Compared to Regional Median |

| Property Tax | 41 | 41.2% below | 9 | 35.3% below |

| Sales Tax | 37 | 22.2% below | 9 | 30.5% below |

| Individual Income | 32 | 19.2% below | 6 | Equal |

| Corporate Income | 40 | 54.8% below | 7 | 2.9% below |

| Overall Ranking | 51 | 32.7% below | 11 | 19.2% below |

Because of relatively low income in Idaho, the state’s overall tax burden relative to income is 46th nationally and 11th among the 11 western states.

| Type of Tax | National Ranking | % Compared to National Average | Regional Ranking | % Compared to Regional Median |

| Property Tax | 38 | 26.4% below | 9 | 22.1% below |

| Sales Tax | 27 | 1.8% below | 9 | 9.3% below |

| Individual Income | 25 | 2.0% above | 4 | 12.0% above |

| Corporate Income | 37 | 43.0% below | 5 | 6.4% above |

| Overall Ranking | 46 | 15.1% below | 11 | 6.5% below |

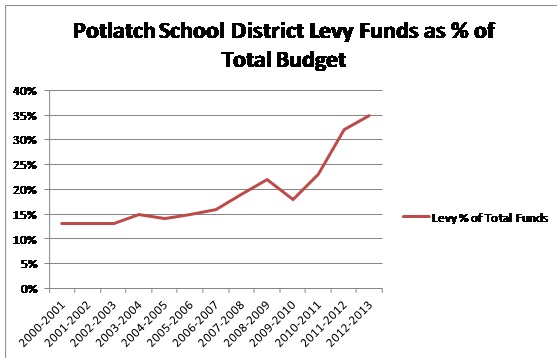

Idaho has a public revenue drought. We are last in the country in our K12 investment per student. We have the lowest wages and personal income in the nation. We cannot maintain our roads or buildings. This has forced our local taxing districts to pick up the slack to fund their schools. Business personal property tax is one revenue source that helps ease the burden on local communities and the families within them.

This tax may be tedious, but it is one of the building blocks that provide a foundation to maintain the public good. To address these concerns, we must weigh the options. Keep the tax at cost to big business, or eliminate at cost to communities? Times have changed since the founders developed our Constitution, but our basic principles have not. Before “racing to the bottom,” we have to look at how we can adjust a bad tax while still keeping communities whole.

Last fall at a campaign event in a small town I met a tall, quiet man who owned a trucking company. He introduced himself to me and bent down to say, “You need to raise my taxes. These lousy roads are destroying my business.” I smiled and thanked him. I wonder if he voted for me. He looked like a Republican.

I really appreciate your very good reports. Until I read your response from a Constitutional Lawyer (who know a lot more thannI do too), I’d hoped the AG would say we have a mandate (“shall”?) to maintain the property tax. I don’t trust your fellow legislators to consider the extreme damage removing the tax would have to most counties, and esp. to schools. What about the fact that there is no revenue to replace it. I don’t trust or respect IACI and their lobbyists at all…..pure greed.